|

Digital disruption is a term used to describe the rapid changes that are occurring in industries and businesses as a result of technological advancements. The rise of digital technology is transforming the way we live, work, and communicate, and it is disrupting traditional business models and industries.

In this series of articles, we explore the concept of digital disruption and its impact on various industries, from retail and healthcare to finance and education. Whether you are a business owner, a technology enthusiast, or simply curious about the impact of digital technology on our world, this series of articles will provide you with valuable insights and perspectives on one of the most significant and transformative forces of our time. Digital Disruption and the Smart City Challenge Digital Disruption and the challenge to the UK Banking System Digital Disruption and the Empires of the Cloud Digital Disruption, which jobs will be at risk in the years ahead Digital Disruption, reading and Book References Digital Disruption and the Industries of the future Digital Disruption : How Google and Facebook disrupted the Yahoo model Digital Disruption : The Six Global Forces scaling Digital Disruption Digital Disruption : So what do we mean by Digital Disruption Digital Disruption : Don’t thumb your nose at Digital Disruption

0 Comments

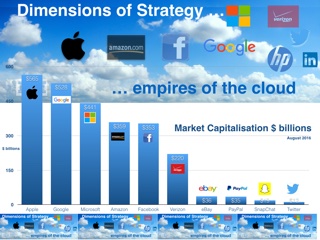

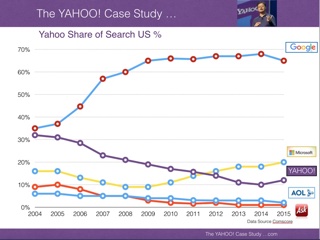

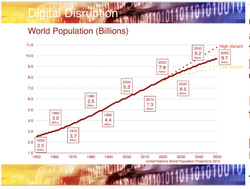

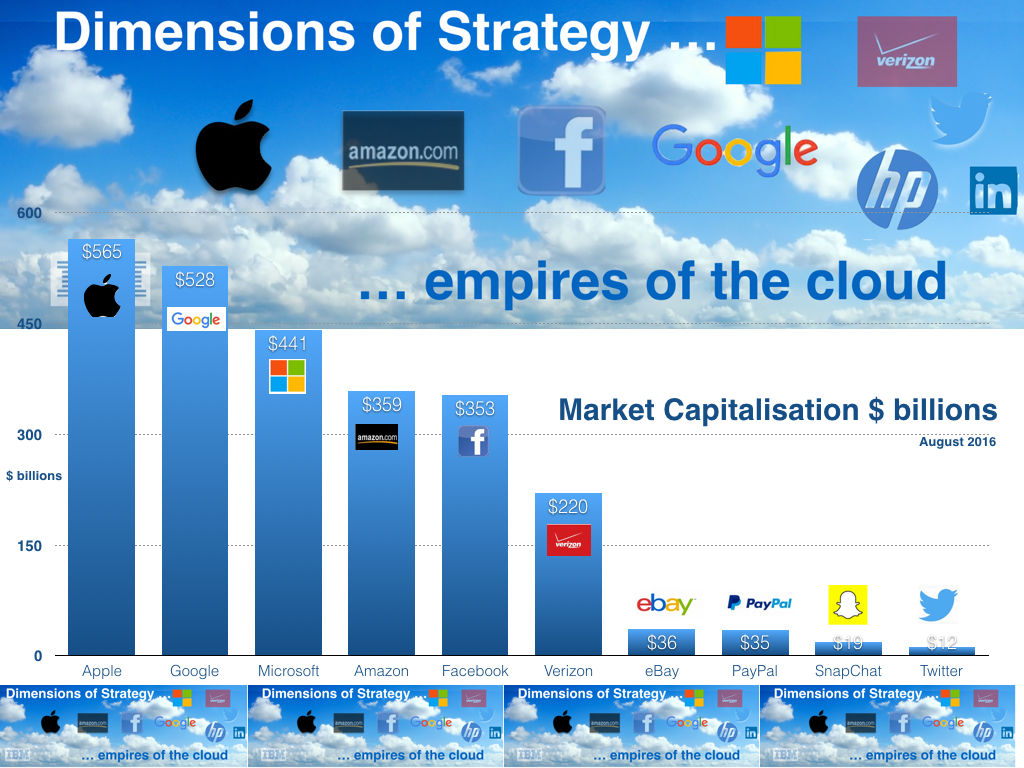

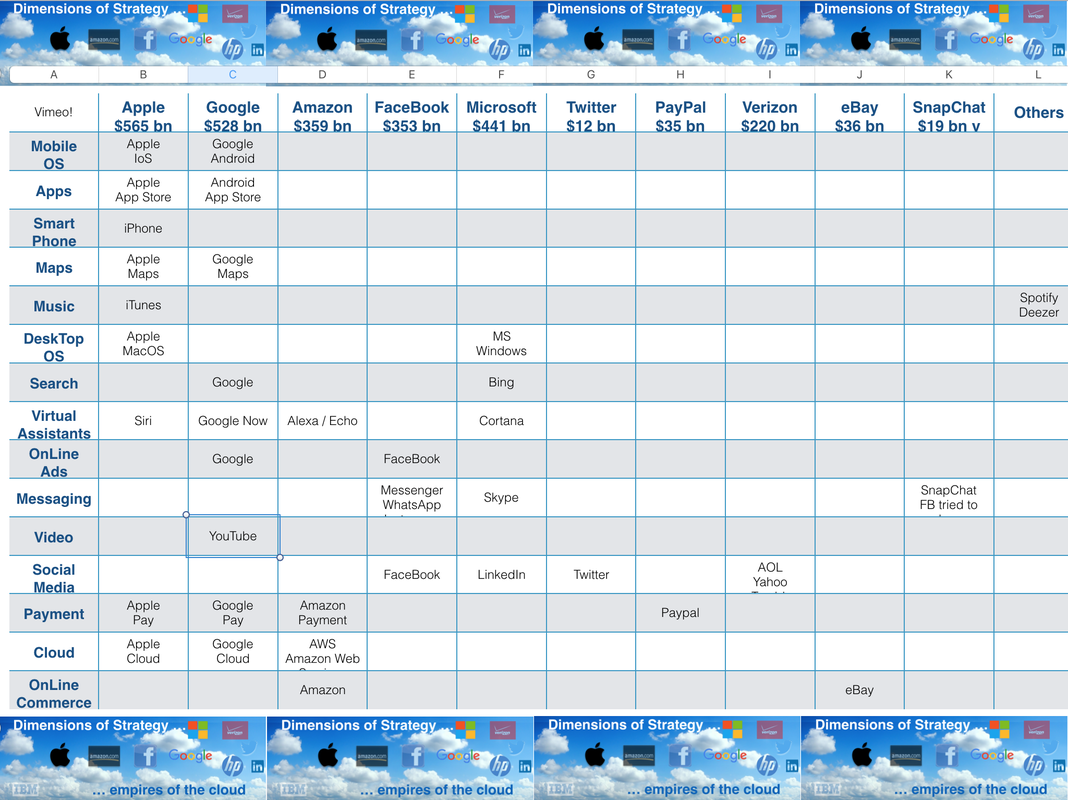

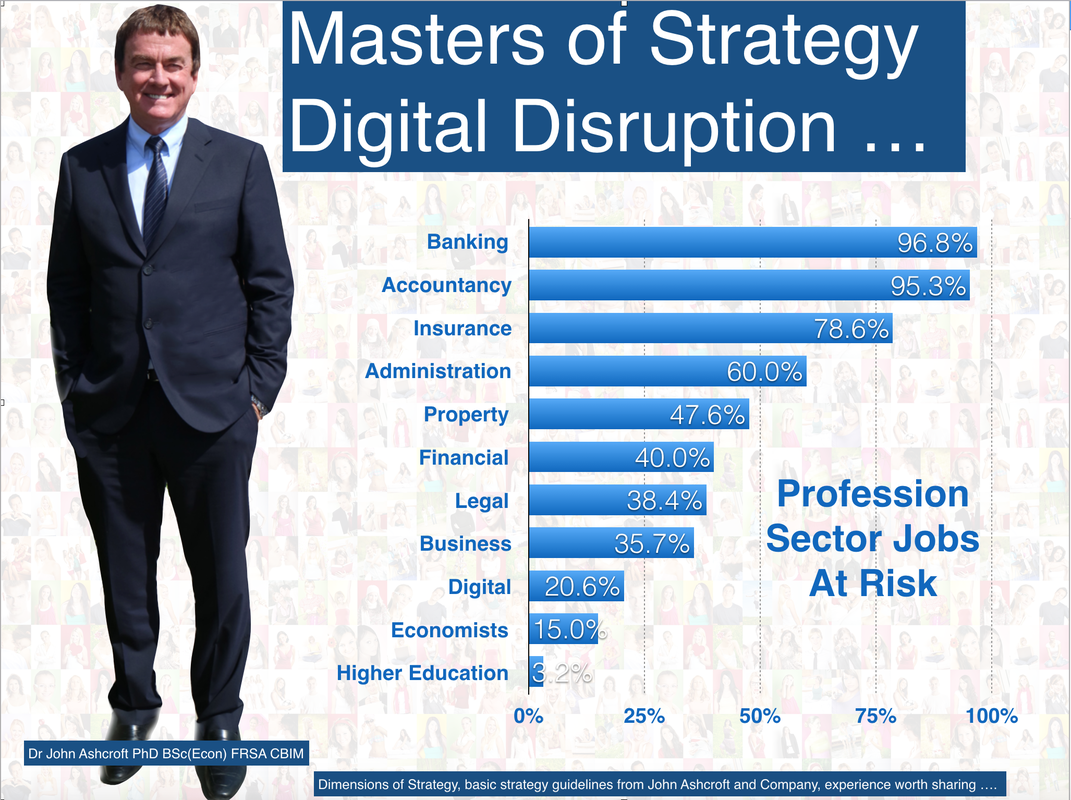

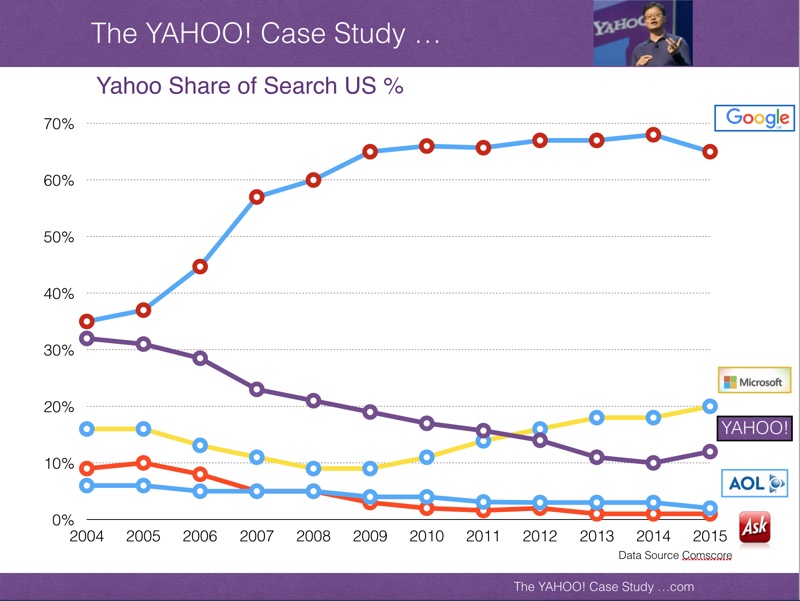

Just 65 km southwest of Seoul in South Korea, on 1,500 acres of reclaimed land, the new “smart city” of Songdu is taking shape. The international business district will feature, schools, hospitals and offices plus leisure and cultural facilities. The 10 year project will cost in excess of $40 billion. It is allegedly one of the most expensive development projects ever undertaken. It is also one of the “smartest” and the “greenest”. 80,000 apartments, 5 million square metres of office space and one million square metres of retail space, will deliver the lightest carbon footprint. All major buildings would be on par with or beyond LEED requirements. 40% of surface area would be reserved for green space. Bicycle lanes, electric car charge points and self drive cars will limit inner city pollution. A hi-tech waste collection system will improve the performance of the carbon emissions challenge. The Songdu rubbish collection system, based on suction pipes, guarantees trash flows from buildings to processing plants, without the need for garbage trucks and rubbish bins. Computers installed in all buildings will enhance the connectivity of ICT, Information, Communications Technology with IoT, the Internet of Things. Residents can video conference with neighbours and attend events, conferences or study lessons on line. Lighting, heating, air conditioning and more can be controlled by digital devices. Real time data will be made available of energy and utility usage. In the age of the Internet of Things, the pot will call the kettle back on wifi as the fridge replenishes key items from auto order and home delivery by drone. In Songdu, water filter systems will ensure prime quality drinking water is not used to “flush the toilet”. Vertical farms will provide fresh food from urban “farm sky scrapers”. Delivery drones will provide home delivery. Living street lights in the form of trees and bushes will enhance urban architecture. In transport, intelligent digital communication installations, will provide real time data on public transport arrivals and departures and of course delays. Auto parking facilities will ensure, car owners are notified of available parking in and around the city. Co-ordinated transport networks, with universal contactless of mobile payment systems will simplify the process of commuter progress to, from and within the city. Not just in Korea are the changes being made. Travel around Helsinki in 2016, the city's new Mobility-as-a-Service initiative will allow commuters to buy a "mobility" ticket via text message or app. The service will plan the ideal route from starting point to destination, combining public transport, on-demand services and private vehicles. In Zaragoza, Spain, a "citizen card" will provide access to the free city-wide Wi-Fi network, unlock a bike share, check a book out of the library and pay for the bus ride home. In Songdu, the smart city is starting from scratch. It is a huge advantage. “From an infrastructure perspective, we could lay the very latest connectivity technology into the ground before construction," says Tom Murcott of real estate developer Gale International,. Gale International is building the Songdo International Business District, partnering with Cisco. Gale will provide the internet-of-things backbone for Songdo's buildings. "This will allow the occupants to control their air conditioning, their televisions, their music even their elevators" Murcott says. "Cisco has built an high definition tele presence system installed in 14,000 residential units. Residents are able to interact with city administrators, shopkeepers, socialcare and healthcare workers." Interactive video networking with first line health care can lead to better monitoring of first response screening, patient monitoring, medical pill dispensation and much more. In transport, distribution, energy consumption, health care and so much more, the yield from the Smart City challenge will be tremendous. The opportunities afforded by digital disruption can only improve the yield. By 2050 it is estimated that 75% of the world's population will live in cities, putting pressure on transport networks, emergency services and utilities already stretched to capacity. It may be easy for a clean start project to establish the basic infrastructure as the first foundations of the city are formed. Certain challenges of progress remain nevertheless. “Birds Korea” called for a halt to the Songdu reclamation project due to the loss if important tidal flats, supporting threatened waterbird species and providing a staging ground for migratory waders. Fears for data privacy will be overtaken by lifestyle privacy. Smart cities need smart networks into which everything and every one is hooked. What if the smart city system is hacked and or falls into the wrong hands? The FBI already advise computer owners to cover the smart camera for fears of hacking and home intrusion. In Manchester, great things are expected from the CityVerve challenge. In December last year Manchester was chosen as the winner of a £10m Government-led technology competition to build and deliver a smarter, more connected Manchester. The plan - to create a city that uses technology to meet the complex needs of our people. CityVerve brings together the brightest minds and pioneering use of Internet of Things (IoT) technologies to redefine ‘smart’ in the context of a living, working city. “Imagine a Manchester of endless possibilities from new business and jobs to better healthcare and transport; safer streets; and more engaged and empowered citizens. We’re teaming this incredible expertise with cutting edge technology; engineered and delivered by the greatest minds from across the globe.” And this isn’t just a reality for Manchester; CityVerve aims to create a blueprint for smart cities worldwide. The ambition is huge. Join us in March at the pro-manchester business conference. We consider the outcome of digital disruption and the smart city challenge. We look at the opportunities for Manchester and the opportunities outlined by the CityVerve project. This will be the tenth in the pro-manchester conference series over the last seven years. We think it will be our biggest and best yet.  Digital Disruption and the Challenge to the Banking System … This week the Competition Market Authority [CMA] released the final report on the UK Banking System. Despite fears about digital disruption and the potential “uberization” of the bank network, change is slow to take effect. The report concludes the smaller, newer, “challenger” banks find it difficult to grow. Older, larger, legacy banks do not have to compete “hard enough” for customers’ business. Switching, the process by which customers change bank accounts from one bank to another is still extremely low. Switching accounts for between 3% and 4% of total current account business. The CMA would like to see the dominance of the Big Four, HSBC, Barclays, Lloyds and RBS diminished. In 2014 it is estimated the big four, plus Santander, have a combined UK current accounts market share of 85%. Add in TSB, Nationwide and the Co-operative Bank and the total increases to 97%. For the new challenger banks like OakNorth, Aldermore, Starling, Monzo and Atom the challenge is particularly difficult. Despite a strong Fintech mobile platform, Monzo, Starling, Atom and Tandem will struggle to recreate, in banking, the success of AirBnB and Uber in hotels and transportation. Scaleability is a difficult growth challenge when confronted with customer inertia. In banking, far more is at risk than calling a cab or booking a room. The commitment Life Time Value [LTV] has much more at stake as clients put their savings, houses and transactions on the line. Customer inertia, with a switching rate sub 4% will inhibit the growth of challengers whether digital or not. The marketing spend and capital requirements to achieve critical mass, are significant impediments to rapid growth. So what can the CMA achieve ...? The CMA would like to develop an “Open Banking” network. A world in which customers are able to move accounts more easily and more regularly. Price and performance comparisons should feature as part of the banks’ marketing profiles. APIs would be linked to all major banking systems. Clients would receive reliable, personalised, financial advice, precisely tailored to individual circumstances delivers securely and confidentially. Big data and predictive analytics would enable cash forecasting to warn of impending overspending. The standards set by the Empires of the Cloud, Google, Apple, Facebook and Amazon are becoming the norm for the banking network. “People who bought this also bought this, but you can’t afford it - so don’t look at that site again!” With Open Banking, apps could use transaction information to find the current account deals which suit best. Running a small business, apps could find the best options for business accounts and loans. Apps could even help avoid overdraft charges by moving cash into accounts when they dip into the red. Unfortunately the CMA fails to explain where the cash would come from. It’s all based on the wonderful world of fantasy banking. A world in which businesses and individuals never get into financial trouble. A world in which cash is always available at a tap of a button. Maybe soon, there will be an app for that. The “Money-App-tree” may be on the digital horizon but not just yet. More choice, more competition, greater market fragmentation, greater product innovation, disaggregation, right sizing the banks. It all sounds so easy. Monzo is about giving customers the data and insights into their spending and saving with warnings of overspend and shortage. But is that really a sufficient point of differentiation? Predictive capacity may be a wake up call for the legacy banks but not much more. Big progress is already being made by the big four and others in the world of relationship banking. Banks are adapting. Capital One Bank acquired UX design agency “Adaptive Path” and the App - Level Money to push ahead in the digital space. How the Big Banks will respond ... ? The legacy banks have size and experience on their side. They have big balance sheets and big networks plus experience with the regulators, retaining the confidence of investors and clients. They have established relationships, data history, data availability, a spread of products, services, risk management analysis and the scale of operations to sustain large market shares. They do have legacy software systems and architecture which are demanding huge investment to make the move to digital and mobile. They are responding by developing startup or VC programmes with FIntech companies, partnering or acquiring Fintechs or developing resource in house. Santander’s Innovation, Barclays Pingit App and Accelerator schemes, Lloyds Digital Champions, Citibank’s Digital Mobile Challenge and Digital Acceleration teams are witness to the response to the challenge. Fintechs will struggle to gain critical mass. The legacy banks will react by collaborating, competing or acquiring either totally or by partial investment. Doing nothing is not an option. Empires of the Cloud … The Empires of the Cloud, Google, Apple, Facebook and Amazon are defining the standards for digital UX user experience and UJ user journey. Millennium clients are expecting the same standards of service and response from banking platforms as they are from Amazon and others. Payment offers easy pickings as a challenge to the banking network. It is the most vulnerable to digital disruption. 2015 was the year of successful IPOs from PayPal, Square and WorldPay. The success of Paypal and Transferwise have determined the standards for ease and speed of money transfers both nationally and internationally. New players like Transferwise may grab the headlines but Western Union will remain the dominant player in the international payment market. Visa and MasterCard remain strong players in the transaction market. “Contactless” is a great step forward in the digital age. Google, Apple, Facebook and Amazon all have payment options with “Wallet” (differential card payment options) as an enhancement. Facebook paid $19 billion for WhatsApp as an addition to the social media network. The pattern of payment via messaging options have been set by WeChat in China. Payment and messages are able to use the same platform among Facebook’s 1.7 billion users worldwide. Empires of the Cloud will be the main threat to the banking system rather than the newer, smaller Fintechs. Apple, Google, Facebook, Amazon have the relationships and the platforms to disrupt the conventional banking network. Once the banks are obliged to access with APIs then the disruption is eased significantly. Will we see the Bank of GAFA in the years ahead? An interesting thought when one considers the combined capitalisation of the Empires of the Cloud is $2.5 trillion dollars. RBS, Barclays and Lloyds, each would represent a modest premium to a WhatsApp deal based on current valuations. Imagine if the Empires strike back, what would the CMA make of that! Happy (Digital) Strategies, John  Empires of the Cloud ... Empires of the Cloud are dominating internet activity. Software as a Service is yielding to Business as a Platform. We hear much about Uber and Airbnb as the great disruptors. Uber is the largest taxi firm in the world, yet has no vehicles, Airbnb is the largest “room rental" business in the world but owns no hotels. In reality, Uber and Airbnb are minor niche players in the great game. Five key “Empires of the Cloud” are emerging. Apple, Google, Microsoft and Facebook are joined by Verizon, making a late run. Together our top five “Empires of the Cloud”, have a combined market value of $2.5 trillion dollars. The battlegrounds have formed on which the empires will joust. The quest for dominance is relevant and real. Google dominates search, Facebook and Google dominate on line advertising. Amazon dominates online commerce. Apple and Google dominate mobile software and apps marketing. Personal Assistants rival amongst the big four. Apple’s Siri, Google’s Now, Microsoft’s Cortana and Amazon’s Alexa-Echo, each seek to have the last word. In Social media, Facebook is the dominate player with 1.7 billion monthly users. It is a huge player, intent on maintaining dominance. The acquisitions of Instagram and WhatsApp, the latter for $16 billion, are evidence of Facebook’s commitment to the cause. Attempts to acquire Snapchat for $3 billion have failed to date. The launch of Instagram “Stories” is clearly targeted at the reluctant seller. Facebook hosts “Messenger”, alongside Instagram and WhatsApp to provide a comprehensive social media offer. Verizon acquires Yahoo … Verizon’s acquisition of Yahoo brings Yahoo and Tumblr into the Verizon stable to sit along side AOL. Yahoo’s 700 million MAUs are a big addition to the empire. Microsoft’s acquisition of LinkedIn for $16 billion brings over 300 million MAUs into the Microsoft camp. In payment, Apple Pay, Google Pay and Amazon Pay have strong payment platforms to support the high level of platform transactions. PayPal is the major independent with a strong history with eBay. PayPal and eBay are currently valued at $35 billion. Twitter and Snapchat with market caps of under $20 billion sit as acquisition fodder before the Empires of the Cloud. New Empires of the Cloud are governed by the old rules of competitive strategy. The race to critical mass is important for market dominance. For new business platforms, development is a function of runway and burn rate. Serial losses may be sustained in start up phase, as long as the model fundamentals are correct. Cost of Acquisition cannot exceed Life Time Values. Transactions with revenues below cost, may be OK as a short term loss leader for certain items but not in the overall product mix. Walmart’s acquisition of Jet is an interesting case in point. According to the Wall Street Journal, transactions sustained at a loss were a significant part of the Jet retail model. In October last year, Jet had a monthly burn rate of $40 million, including a $25 million advertising budget. With $63 million of cash left at the end of October, the company avoided a cash crunch when it raised $350 million in November. It is suggested Walmart is paying $3 billion for an unproven retail model to boost online performance and create a rival platform to Amazon. Good luck with that! Empires expand, laterally, horizontally and vertically. Empires will seek to expand where the perceived value is greatest. Sometimes, this will involve co-opetition, working with the enemy. Take note, Alibaba (not Baidu) owns search on Alibaba. Facebook (not Google) owns search on Facebook. Apple, dependent on Google for Maps for the iPhone decided to drop Google. The decision to develop an Apple “Map App” in house was strategically important, albeit badly executed at the out set. Yahoo made a great strategic mistake in surrendering search to Google as we explain in The Yahoo Case Study. Facebook and WhatsApp… The Facebook acquisition of WhatsApp for £19 billion was as much a defensive acquisition as it was a strategic play. WhatsApp has more than 400m users around the world heading for one billion within the next three years, or so it is hoped. Facebook’s successful close in 2014 followed a Google offer of $1 billion for the company in the previous year. Facebook was prepared to overpay to avoid a rival empire seizing control. In China, the empires are well established with Alibaba in commerce, Baidu in search, WeChat in messaging and Xiaomi in mobile. For the firms of the West China is a difficult market. Last month Uber made a strategic withdrawal, swapping China operations for a stake in homegrown rival, Didi Chuxing partially owned by Baidu. Empires of the Cloud operate within the old rules of the game. We define the battlegrounds amongst search, advertising, payment and many more. Empires monitor the battleground using our formula of CBS News. Competitors, Buyers, Suppliers, New Products, New Players, New Platforms and New technologies. Product life Cycles are significant as always in monitoring corporate performance. Snapchat will face a greater challenge from Google’s Instagram. Etsy will face the challenge of Amazon Homemade. The development of cloud has seen the emergence of Apple, Google and Microsoft Cloud Products. Nothing compares to the dominance of Amazon Web Services in the provision of cloud storage for many online platforms. AWS provides a great ability, along with Amazon Platform, to monitor performance of the new arrivals, ready to move when the time is right! New entrants will come and go but the Empires of the Cloud will be watching every move … Happy (Digital) Strategies,  “The Future of the Professions” predicts job decline. In an Internet society, according to Richard Susskind and Daniel Susskind, we will neither need, nor want, doctors, teachers, accountants, architects, consultants, lawyers, and many others, to work as they did in the 20th century. Not only will work practices change but the numbers of people involved in the process will decline significantly. Using the models provided by the BBC, Deloitte and Oxford University, we quantify the projected loss in the different sectors over the next twenty years. The Future of the Professions explains how artificial intelligence will bring fundamental change in the way the 'practical expertise' of specialists is made available. In the digital age, our current professions appear antiquated and opaque. Traditional business models are vulnerable to digital disruption given free access to the internet of knowledge by things of choice. Professions will be forced to confront the challenges of automation, innovation, online access and different ways of communication. Accessing data and managing data has never been as easy or as affordable. Businesses are adapting to the virtual workforce with remote working, home working and above all access to specialist expertise on an ad hoc basis. For businesses and individuals, this is the era of information liberalisation. Access to online self help, with crowd collaboration and experience sharing means individuals can receive personalised advice as never before. In Sickness and in health … Some of the great changes will occur in the medical profession. Already, devices like Jawbone, Fitbit and MyFitnessPal are able to generate large volumes of data, for self health monitoring including pulse rates, calorie burn, sleep patterns and happiness levels in real time 24/7. This is the era of the wearables. Artificial Intelligence is helping too. In December 2014, the US Department of Veterans Affairs signed a $6 million contract with IBM’s Watson to advise on Post Traumatic Stress Disorder. In March 2015, Novartis announced a deal with Google to develop a contact lens that monitors blood sugar levels. Developments in “wearables” will be mirrored by developments in ingestibles. A series of nano products will enable internal monitoring and adjustment. A sort of “swallow your surgeon” option with nano devices wandering around the blood stream annihilating problematic cell structures in free time. In Eric Topol’s The patient will see you now! Eric argues the future of medicine will be in your own hands. you could use your smartphone to get rapid test results from one drop of blood, monitor your vital signs both day and night, and use an artificially intelligent algorithm to receive a diagnosis without having to see a doctor. All at a small fraction of the cost imposed by our modern healthcare system. Computers will replace physicians for many diagnostic tasks. “The robot will see you now!” Massive, open, online medicine, where diagnostics are done by Facebook-like comparisons of medical profiles, will enable real-time, real-world research on large population samples. In Star Trek, a medical tricorder is used by doctors to help diagnose diseases and collect body information about a patient. A tricorder in every home should be the aim of a future NHS. Buy one get one free, would guarantee a second opinion. Bulk buying options would cater for hypochondriacs with a basic mistrust of the medical profession. Education … In Education, there are already huge changes taking place as a result of digital disruption. It is estimated the over one billion education apps are installed on digital devices around the world. In “Learning with Big Data, The Future of Education: Viktor MayerSchönberger and Kenneth Cuvier Courses” talk of courses tailored to fit individual pupils and textbooks that talk back. This is tomorrow’s education landscape, thanks to the power of big data. These advances go beyond the much-discussed rise of online courses. The surge in MOOCs - Massive Open Online Courses is surrendering to SPOCs (Small Private Online Courses). Harvard, one of the world's most influential universities, is evaluating a move to Spocs. Consider that each month half a billion people dip into 35 million articles on Wikipedia. Every expert in the world on any subject is just one click away using Google Search. The era of the “Sage on the Stage” is ending. The concept of “The Guide on the Side” will emerge. The digital age, is an age of snap learning. Two minute video clips and 140 characters on Twitter are conditioning students to reject the lengthy tomb and learned paper. Legal and Accountancy … In the legal profession, huge disruption is already taking place with the emergence of paralegals, automation, AI and the break down of the classic legal partnership function. In “Tomorrow’s lawyers” Richard Susskind suggests, the legal profession will change more rapidly over the next twenty years, than it has over the last two hundred years. Susskind sees a legal world of virtual courts, Internet-based global legal businesses, online document production, commoditised service, legal process outsourcing, and web-based simulated practice. Legal markets will be liberalized. Yet, far from reducing the number of people employed in the legal sector, there could be new jobs for lawyers and new employers. In accountancy it is estimated just 1% of tax jobs will be free from the risk of automation. Accountancy packages such as Xero, Cashflow and QuickBooks are easy to use and cloud based. New software is making inroads into the older established hard to use packages which are more specialist dependent. So which sectors will be at risk … Last week we discussed the speech delivered by Andy Haldane in which he suggested that almost half the workforce, or 15 million jobs could be at risk as a result of AI and robotics. Oxford University academics Michael Osborne and Carl Frey calculated how susceptible to automation each job is based on nine key skills required to perform it; The list includes social perceptiveness, negotiation, persuasion, assisting and caring for others, originality, fine arts, finger dexterity, manual dexterity and the need to work in a cramped work space. The results in association with Deloitte were published on the BBC website. Sectors most at risk were banking, accountancy, tax and insurance. Sectors least at risk were Digital, Creative, Higher Education and (I am happy to say) economists. Upload our extended analysis here! Should we be too worried? As we mentioned last week, the technology debate was re-stirred in the 1930s, at the time of mass unemployment during the Great Depression. In “Economic Possibilities for our Grandchildren”, Keynes predicted on-going technological advance and workers being replaced by machines (Keynes (1930)). Fewer working hours and more leisure time the predicted outcome. We heard this later almost fifty years ago with the forecast demise of manufacturing and the huge job losses predicted as a result. Will it be so bad? Projections over the net twenty years are difficult to accept and sustain. But every business should check out vulnerability to Digital Disruption. Stay with us on our journey as we examine the challenge of Digital Disruption in our Masters of Strategy series. Next week, we will look at “Empires in the Cloud” ... the key players creating the dominant digital platforms for the years ahead. Happy (Digital) Strategies, John John Ashcroft PhD BSc(Econ) FRSA, CBIM Reading and Book references ... 1 The Future of the Professions: How Technology Will Transform the Work of Human Experts Jan 1, 2016 by Richard Susskind and Daniel Susskind 2 Learning with Big Data , The Future of Education: Viktor MayerSchönberger and Kenneth Cuvier 3 The Future of Employment Carl Benedikt Frey and Michael Osborne. Rise of the Robots: Technology and the Threat of a Jobless Future by Martin Ford and Jeff Cummings 4 Tomorrow’s Lawyers, Richard Susskind OUP 2013 5 The patient will see you now! TheFuture of Medicine is in Your Hands Eric Topol Basic Books 2015 5 'The Future of Employment: How susceptible are jobs to automation'. Data supplied by Michael Osborne and Carl Frey, from Oxford University's Martin School. 7 Deloitte The Robots Are Coming 2015 8 Figures on UK job numbers and average wages from the Office for National Statistics and Deloitte UK. 9 The Future of Employment: How Susceptible are jobs to computerisation. Carl Benedikt Frey and Michael A Osborne. September 2013.  Impact of the Internet The Internet has had a world-changing impact on businesses over the last twenty years. Cloud technology has emerged. Access speeds have increased as the costs of data processing and storage have fallen. Online connectivity is huge. We claim 2016 as the year of singularity when the number of digitally connected devices, equalled the number of people on the planet. From a level of around 7.4 billion this year, we forecast the number of digitally connected devices will increase to around 11 billion by 2020, peaking around 15 billion by 2030. It is estimated the internet of things could lead to over 50 billion devices connected to the internet by 2020. Over the next ten years, change could happen even faster. The rate of change is increasing. Not exponentially, that’s just a function of how you squeeze the x axis. It is increasing at a faster and faster rate. Industries of the future … So which will be the industries of the future? That’s a tough assessment. Using the Donald Rumsfeld formula, there are known knowns, the things we know we know; There are known unknowns, the things we know, we don’t know; But there are also the unknown unknowns, things we don’t yet know, we don’t know. This is the great suspicion about forecasting and determining the industries of the future with so little hard information other than history to guide us. Things will happen of which, as yet, we know nothing. In 1943 Thomas J Watson Chairman of IBM claimed “There is a world market for about five computers”. In 1950 Popular Mechanics reckoned “Computers in the future may weigh no more than 1.5 tonnes”. Now in the digital age, the ambition for advanced economies at least should be a computer (or digital device) in every home and high speed broadband access for all. So which will be the industries of the future? Where better to start than with Alec Ross and "The Industries of the Future". As Hillary Clinton's Senior Advisor for Innovation, Alec Ross travelled nearly a million miles to over forty countries. “From refugee camps in the Congo and Syrian war zones, to visiting the world's most powerful people in business and government, Ross's travels amounted to a four-year masterclass in the changing nature of innovation”. In "The Industries of the Future", Ross distils his observations on the forces that are changing the world. He highlights the best opportunities for progress and explains how countries thrive or dive. Ross examines the specific fields that will most shape our economic future over the next ten years, including robotics, artificial intelligence, the commercialisation of genomics, cybercrime and the impact of digital technology on so many areas including “precision agriculture” Ross gives readers a vivid and informed perspective on how sweeping global trends are affecting the ways we live, now and in the future. In this week’s feature, we are going to focus on robotics, artificial intelligence, data mining and predictive analytics. Sectors in which the future is already encroaching on the present. Global spending on robots was an estimated $15 billion in 2010. By 2025 it is estimated to rise to $67 billion. Robotics … We have heard many scare stories of the invasion of robotics into the work place. Hundreds of thousands of jobs lost to the next generation of mechanoids. Droids equipped with a better AI software load soon with an emotional quotient. A robot that can laugh at, and cry with, the workers to be displaced. From the professions to care homes, the installation of robots will disturb the current perception of the work place. We accept the installation of robotics on the production line. Confronting “Cognitive Agents” at Enfield Council and other local authorities may yet be a step too far too soon for many rate payers. Andy Haldane Chief Economist at the Bank of England delivered a speech in November last year suggesting 15m UK jobs could be taken by robots as automation spreads through the workforce, thats half the workforce! No need to worry about immigration in the years ahead. Robots will pick the farm fields of Boston, look after the elderly and deal with aspects of healthcare. Yes the “robot will see you now” will be the call through the surgery. Droids dishing out pills for depression as the displaced seek medication, the likely out turn. Occupations most at risk include administrative, clerical and production tasks. For an accountant, the probability of vocational extinction is 95%. For a hairdresser, it is 33%. For economists the potential extinction quotient is much lower at 15%. Should we be worried? Concerns about job substitution are hardly new. As Haldane explained, the technology debate was re-stirred in the 1930s, at the time of mass unemployment during the Great Depression. In “Economic Possibilities for our Grandchildren”, Keynes predicted on-going technological advance and workers being replaced by machines (Keynes (1930)). Yet far from being a threat, Keynes viewed this as a huge opportunity. He predicted that, by 2030, the average working week would have shrunk to 15 hours. Technology would give birth to a new “leisure class”. Overnight droid deliveries from a commercial fleet of vehicles on smart motorways may well be the norm. By 2030, just the economists and hairdressers would be fulfilling a working week. AI and Robotics offer great opportunity to fulfil the shortage of doctors, nurses and teachers in the developed world. Great advances in equality, welfare and deprivation can achieved be better access to education and first line medical care in developing countries. Data the raw material ... Lots of excitement too about deep data mining and predictive analytics. As we explained earlier in this series on Digital Disruption, the volume of data to be analysed will explode. Data created by the internet of everything will exceed 500 ZettaBytes by 2020 up from 150 ZettaBytes in 2015. That’s over half a Yottabyte each year with more to come. By 2050 there will be a lot of Yottabytes to be stored and analysed every year. The Google Acquisitions of Boston Dynamics and Deep Mind are witness to the significance of this trend to the internet majors. IBM’s Watson is already placing highly complicated algorithms and neural networks into the hands of many. Deep Mind is currently working with the NHS with a trial of triage assessment in A & E. Data management, simultaneous translation, predictive behaviours will be delivered into the hands of businesses of every shape and size. But what to do with the data ? Predictive technologies developed by Google and Amazon are setting the standards for consumer service, user journeys and experience by which by which all businesses, both B2B and B2C, will be judged. Tesco’s acquisition of Dunnhumby in 2004 helped propel the supermarket to national dominance using the data provided by the Tesco loyalty card. Palantir is building data fusion platforms for integrating, managing, and securing any kind of data, at massive scale. “On top of these platforms, we layer applications for fully interactive, human-driven, machine-assisted analysis” as Alex Camp CEO explains. Great successes have been claimed by Palantir. Using big data to find missing kids.“How Palantir uses Big Data to Find Missing Kids Fortune March 14 2016. Of lesser great social acclaim is that working with Hershey the U.S chocolate giant, crawling through the data base, the Palantir data crawlers discovered Hershey bars sell better when merchandised next to Marshmallows in store. Ah yes, there is hope for humanity. So as with robotics, AI and data mining, businesses must adapt to the challenge of digital disruption by first challenging their own organisations and business models. Join us in our journey as we examine the challenge of digital disruption in our masters of strategy series. That's all for this week, More to follow, Happy Strategies, John  Yahoo and Google ... In the summer of 2002, Terry Semel CEO of Yahoo, approached Google with an offer to buy the company. Google founder Larry Page’s initial asking price was $1 billion quickly rising to $3 billion then $6 billion. It was obvious Page did not want to sell to Yahoo. The founders Larry Page and Sergey Brin wanted to keep the company independent. An IPO of their own was an easy and obvious option to cash up, in part exchange for equity. Semel was rebuffed. The back up plan was to create a rival to Google. Yahoo had already acquired Inktomi for $235 million. Overture had acquired Alta Vista for $140 million. Yahoo acquired Overture in July 2003 for $1.6 billion. The battle lines were drawn between Yahoo and Google. Initially the strategy proved successful. In 2004, the two brands were tied. According to ComScore, Yahoo held 32% of the search market and Google 35%. Yahoo had been the leader in search and online ads for years but now Yahoo had to contend with the Number two slot in a fast growing market. Within two years, Yahoo share of search had fallen below 30%. Google had pushed forward to achieve a 45% share, rising to over 65% by 2009. By 2014, Yahoo was struggling to hold a 10% share of search. Google was the clear market leader with a 70% share. The Google disruption in search was evident. Yahoo and Facebook … In 2006, Yahoo was still the big player on the internet block. Yahoo would see most, if not all deals, on the street. Terry Semel CEO had the chance to buy Facebook established just two years earlier for $1 billion. The Yahoo camp had mixed views about the deal. Some believed that if the campus based web site could be opened up to a wider audience, Facebook could become one of the most valuable social media platforms on the internet. Others had their doubts. The Yahoo protagonists believed the deal could value Facebook at up to $1.6 billion. In principle a deal had been agreed at the magic $1 billion level. A great deal for Zuckerberg after just two years. A great deal for Yahoo too. Semel’s tough love negotiations forced Zuckerberg to walk away from a meagre $850 million offer, never to return. Had Yahoo missed out? Undoubtedly. Within one year, Facebook had taken an investment from Microsoft valuing the company at $15 billion. In 2016, Facebook is valued at $340 billion. Google is valued at nearly $500 billion. Yahoo is valued at just over $35 billion largely due to the investment stakes in Yahoo Japan and Alibaba. Facebook’s share of display advertising surpassed Yahoo, just as Google has achieved in search. Yahoo and First Mover advantage … Yahoo had secured First Mover Advantage as the large internet portal. But first movers are often worst movers if the competitive market advantage is not pressed home. The scale of activity meant the giant could be out manoeuvred by focused start ups in selected areas. Yahoo was in danger of trying to do too much across the internet, without adequate focus in key sectors. The competitive framework was extensive. Google in search and PPC, Facebook in social networking and display ads. PayPal was dominating payment. eBay was emerging as the key name in auctions. Microsoft in email, MySpace in social AOL in messaging and CNN in news and sports. Yahoo had missed out on Google, Facebook, YouTube, LinkedIn and Twitter. Competitor platforms were established in Search, Advertising and Social. Yahoo acquisitions of Overture ($1.6bn) Flickr and Tumblr ($1.1bn) could not reverse the decline. The Yahoo case study is a classic example of Digital Disruption and many other of the key elements of our Masters Of Strategy Guidelines. Download the Case Study. Or why not check out our mobile version available as a YAPP! We really like the YahooYapp! Download and post a comment. Let us know what you think ... Don't miss our regular updates on Corporate Strategy in the Masters of Strategy Series. © 2016 John Ashcroft and Company, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment..  1 Population … Is population growth an influencing factor in digital disruption? Not really!According to the UN World Population data, in 2015 there were 7.3 billion people on the planet. Up from 2.5 billion in 1950 and 5.4 billion in 2000, the world will experience further population growth to 9.7 billion by 2050. Numbers are continuing to rise but the growth rate is slowing. The average rate of world population growth (CAGR) over the last sixty years has been 1.7%. The projected rate of growth of population is set to slow to just under 1% over the next forty years. Greater longevity is offset by lower fertility rates. The world is in a steady state of growth. No evidence in the basic population data to support the digital disruption and exponential disruption phenomena. 2 Connectivity Greater connectivity around the world is one of the factors facilitating disruption. Mobile phones have been key in this regard. The number of mobile phones in use has increased rapidly over the last fifteen years. By 2016, total volume (mobile phones) increased to 8.5 billion compared to a population of just 7.3 billion. There are more phones in use than people on the planet. No wonder, some claim there are more phones than toothbrushes. The phenomenon will not persist forever. We forecast the trend will reverse around the turn of the century. The day of the toothbrush, will return but not for some time yet. By then toothbrushes may be connected to the internet, with feed back on flossing performance and dental decay. But wait we move too fast ... The number of smart phones has increased from less than one billion units in 2010, to approximately 3.2 billion last year and 4.1 billion this year. Conventional mobile (non smart) stocks peaked last year at around 5.5 billion. They are set to decline to 3.3 billion in our model by 2020. We expect the number of phones in use to peak at 9.0 billion in 2020 as the total stock of smart phones increases to just under six billion units. Product life cycles dominate the analysis, in this and in all things. 3 Connected Devices … Of course there are many ways to connect to the internet. We expand our research into “Digitally connected devices”. We include in our analysis - desktops, laptops, tablets, phablets and phones. According to our dataset, the number of “digitally connected devices” has increased from less than 1 billion in 2009 to around 5.0 billion in 2014. We claim 2016 as the year of singularity when the number of digitally connected devices, equalled the number of people on the planet. From a level of around 7.4 billion this year, we forecast the number of digitally connected devices will increase to around 11 billion by 2020, peaking around 15 billion by 2030. 4 The internet of things ... And what of the internet of things? It is estimated the number of “things connected to the internet” could be over 50 billion by 2020. This may well be true. It could even by higher. According to Gartner, there will be nearly 21 billion devices on the internet of things by 2020. ABI Research estimates that more than 30 billion devices will be wirelessly connected to the internet by 2020. 50 billion appears to be a reasonable assumption assuming our 11 billion digital connected devices is correct. To the list of digital devices we add home appliances, connected clothing, medical devices, transportation, buildings and cities. Smart bodies, smart homes, smart cars, smart grids, smart farms, smart roads, smart cities … “Get Smart” will take on a whole new meaning to digital urgency. "Things" as an "inextricable mixture of hardware, software, data and service is the legal definition. People will be connected to the internet via internal and external devices. The pacemaker hooked up to the mainframe offering real time analytics. The digital dispenser offering feedback on medicine consumption and dosage levels. The nano bots coursing through the veins relaying important data on cell counts, sugar levels and genomic disorders. As the cost of chips fall, along with the cost and time of processing the data, the “nerd nirvana nears”. Data storage is made available and the data challenge becomes enormous. What secrets to predictive modelling will be extracted from the huge data flow? Access to market has never been easier and cost of acquisition has never been lower. It is an exciting time for those with the right attitude and the right software to process the data and provide the service. 5 The challenge of data ... And what data there will be! Six years ago, Google’s Eric Schmidt claimed we create as much information every two days as has been created since the dawn of civilisation and the year 2003. In 2015, we probably produced more every day since the birth of the printing press in the first 555 years. The rate of increase is exponential. Videos, photos, audio messages, blog posts are streaming onto the internet in ever increasing proportion. That’s lots and lots of information and lots of need to store. According to the Cisco Cloud Global Index 2015, annual global data centre traffic will reach 10.4 zettabytes by the end of 2019, up from just over 3.4 zettabytes in 2014. Global cloud traffic will reach 8.6 Zettabytes up from 2.1 ZB over the same period. Data created by the internet of everything will exceed 500 ZettaBytes by 2020 up from 150 ZettaBytes in 2015. That’s over half a Yottabyte each year with more to come. That’s a lot of data. How big is a Zettabyte - think Kilobyte (1) Megabyte (2) - Gigabyte (3) - Terabyte (4) - Petabyte (5) - Exabyte (6) - Zetabyte (7) and still to come yottabyte (8). Figures in brackets are the power factors from the humble Kilobyte. Consider the Encyclopaedia Brittanica is approximately 24 GB in total! 6 Data Storage ... Digital connectivity is facilitating the process of digital disruption by reducing access to market barriers and reducing the cost of client or customer acquisition. Word of mouth becomes word of byte. The R(0) increases to spread the information flow. There is of course a downside. Product life cycles become more truncated as the life time values fall in periodicity and value. Storage on the other hand is becoming more accessible to new and fast growing businesses. The failed whale syndrome, identified in our Twitter case study is largely a thing of the past for new businesses. Constant crashes as the MAUs increase should be an anachronism in the digital era. Rapid elasticity is the new mantra for cloud service providers. Start ups and unicorns are able to benefit from the rivalry between Amazon Web Services, Google, HP and IBM cloud. Personal cloud usage has increased from zero in 2010 to over one billion users this year and will increased to 2.5 billion by 2020. The volume of data stored has increased from zero 2010 to 17 exabytes by 2015 and will increase to 45 exabytes by 2020. New industries have emerged to accommodate the growth of the digital era and personal / small business cloud storage. Box.com with a market share of over 50% in the USA, lays claim to a 30% share world wide. The company still lays claim to a market cap of $1.3 billion US. Revenues of $325 million have yet to deliver a profit but that is no longer a critical KSF in the digital age. Conclusions ... Population growth, mobile connectivity, digital devices, the internet of things, data generation, processing costs, data storage have lowered the barriers to market entry and participation. Cost of acquisition, MAUsS, life time values have emerged as the new metrics for the digital age. It is the world of Minimum Value Proposition, get it up and get it right. Marissa Mayer’s LEO - launch early and often and Googles SOAR - send out and revise are the new guidelines for product success. But in many ways, the old corporate strategy guidelines remain dominant. Product life cycles are so important. Exponential growth rates are merely a phenomenon of the width of the x axis and the size of the R(0). Understanding the challenges of digital disruption to an existing business player, require the traditional framework identified in our CBS NEWs analysis. Benchmark and market map, all things at all times. Profile Competitors, Buyers, suppliers and new products, new players, new technologies and new platforms. Next week we will examine the industries of the future, so important in the digital age …  Over the next few weeks we will be looking at a whole series of articles on Digital Disruption. Our series will include The Six Global Trends Shaping Digital Disruption, The Five key Players in the Internet Space, The Five Dynamics Shaping Digital Disruption, We will also be looking at “The robots will see you now : The future of healthcare” and “No time for time sheets : The Future of the professions”. Plus, “The Six Industries of the future and how they will impact your business”. So what do we mean by digital disruption … Our series begins today with an introduction : So what do we mean by digital disruption. We sum it up as “A threat to business goals and or financial objectives which can be attributed to a digital product or platform online. Access to market has never been easier and inexpensive … The world population is 7.5 billion. Over 3.5 billion have internet access and 1.5 billion have a smart phone. The number of mobile phone users in the world is expected to increase to over 5 billion by 2019. Of which 2.5 billion will be smart phones. It is the age of the internet of things. By 2020 it is suggested that over 50 billion “things” will be connected to the internet. Computers, laptops, iPads, game consoles and of course phones but also intelligent home devices, talking fridges, networked climate controls and more. People will be connected to the internet via internal and external devices. The pacemaker hooked up to the mainframe offering real time analytics. The digital dispenser offering feedback on medicine consumption and dosage levels. The nano bots coursing through the veins relaying important data on cell counts, sugar levels and genomic disorders. Access to market has never been easier and cost of acquisition has never been lower. It is an exciting time for those with the right attitude and the right App! Software as a Service … Software Specifically Software as a Service SAAS, is the great disruptor. We think of current examples like Uber and AirBnB, impacting on the taxi or hotel industry or Netflix impacting on CBS and NBC. The examples of the Kodak moment are cause for concern for any business. Now internet access to the wisdom of crowds is collapsing the time frame of product and corporate life cycles. Businesses must confront the digital challenge and be prepared to confront and cannibalise their existing business models before someone else does. The businesses surviving in the digital world will those that have created a learning organisation, constantly challenging using a clear strategic framework. Let the cannibals loose in the corporate silos, the new mantra. Data is increasing at an Exponential Growth ... Data is increasing at a phenomenal rate. The cost of data processing and storage is collapsing, the speed of access is accelerating. Access to information is universal, ubiquitous and fast, There are few hiding places for corporate intrigue or mystique. Consumers have access to lots of information via a pocket device, any time, anywhere. It is the end of the HIPPO. The highest paid person’s opinion must yield and give voice to the wisdom of the crowd. Six years ago, Google’s Eric Schmidt claimed we create as much information every two days as has been created since the dawn of civilisation and the year 2003. In 2015, we probably produced more every day since the birth of the printing press in the first 555 years. The rate of increase is exponential. Videos, photos, audio messages, blog posts are streaming onto the internet in ever increasing proportion. That’s lots and lots of information. Big data Analysis … But how to analyse the data. IBM’s Watson or organisations like Palantir will be available to assist the process. Standards set by Google and Amazon in predictive analytics, behavioural analysis and product recommendations will set the standards by which all must be judged. Big data analysis may yield big nuggets of information to assist business. We must expect more from the data crop, than learning to place disposable nappies next to the beer, or Hershey Bars next to marshmallows in store to accelerate sales. The great world challenge to end poverty, feed the masses and provide access to water is on hold for now. An analysis of consumer behaviour at Walmart revealed flashlights were in great demand in response to a hurricane warning but sales of Pop Tarts also soared as a companion sale. How to cope with the digital challenge … Our concept of CBS News is an omnipresent in the strategic framework analysis. CBS Competitors, Buyers, Suppliers and News, New Products, Players, Platforms and Products are subject to constant mapping, benchmarking and analysis. The challenge to collate the date, command the data and deliver the analysis in a format which business peers are able to comprehend and share. Sectors at risk ... Which sectors are most at risk? What steps can be taken to alleviate the risk of disruption? All this and more we will discover in our forthcoming series. Businesses must do more to enrich the product or service with information social content and connectivity. Do more of the customers work for them, with recommendations and price comparisons a partial guide Don’t miss the updates from the Dimensions of Strategy Team. Encourage your friends and colleagues to sign up and join the mailing list. Next week, we will reveal our list of the Ten Books you should read to prepare for the digital challenge and “The Four Global Trends Shaping Digital Disruption.” In 2000, Kodak had 170,000 employees and sold almost 90% of photo paper world wide. Together with Fuji, the two companies dominated the photo film business. Not for long, in 2012, Kodak filed for bankruptcy. The business model had been unravelled by the development of the digital camera. A classic example of digital disruption, perhaps.

The Kodak “moment” as we term it, lasted over a period of decades. Kodak had developed a digital camera in 1975, the first of its kind, the camera was dropped for fear it would threaten Kodak's photographic film business … so much for “First Mover Advantage”. Today, businesses do not have the luxury of decades to adjust to the challenge of digital disruption. Digital disruption is now easier, faster and cheaper than ever. The speed of process is accelerating. The rate of change is exponential. It is the era of the “virtual company”. SaaS, Software as Service is the new fast growth business model. Uber is the great disruptor in the taxi business, yet owns no vehicles. Airbnb is the great disruptor in the hotel business, yet owns no hotels. The digital masters, Apple, Google, Amazon and Facebook are setting the standards by which all service companies must be benchmarked. Predictive analytics, pattern behaviour, machine learning, neural networks lead us all in search of the great algorithms which will accelerate consumer access and unlock spending in the future. Understanding the customer, has never been easier but is ever more complex and demanding, such is the growth in the data load. Businesses must adapt to the challenge of digital disruption by first challenging their own organisations and business models. It is said that when the Chinese developed their stealth bomber, the CIA didn’t see it coming. Don’t be caught out. This is the era of digital disruption - No time to thumb your nose at the clear and present danger. Don't miss out on our series of articles on Digital Disruption, out shortly. Our YAHOO case study will be released on Sunday 26th June. We think it is our best yet! Here's another chart from the case study. If you have any comments or suggestions, please feel free to drop me a line. Keep up to date with the latest thinking in corporate strategy. |

John Ashcroft

Masters of Strategy on Digital Disruption from the Dimensions of Strategy Team ... experience worth sharing ... Archives

May 2023

Categories

|

- Home

- Artificial Intelligence

- Digital Disruption

- Digital Accommodation

- The Master Class

- The Case Studies

- Empires of the Cloud

- Letters to a Friend on Social Media ...

- The Tool Box

- Five Dimensions

- CRIMSON Clouds

- Market Mapping

- CBS News

- PESTEL framework

- Kaizen and KSFs

- Business Modelling

- 7 Ss Framework

- Crisis Management

- Secrets of a great presentation

- Business Planning

- Fishing in a Pond?

- About

- The Apple Case Study

- The Lego Case Study

- The Yahoo Case Study

- The Twitter Case Study

RSS Feed

RSS Feed