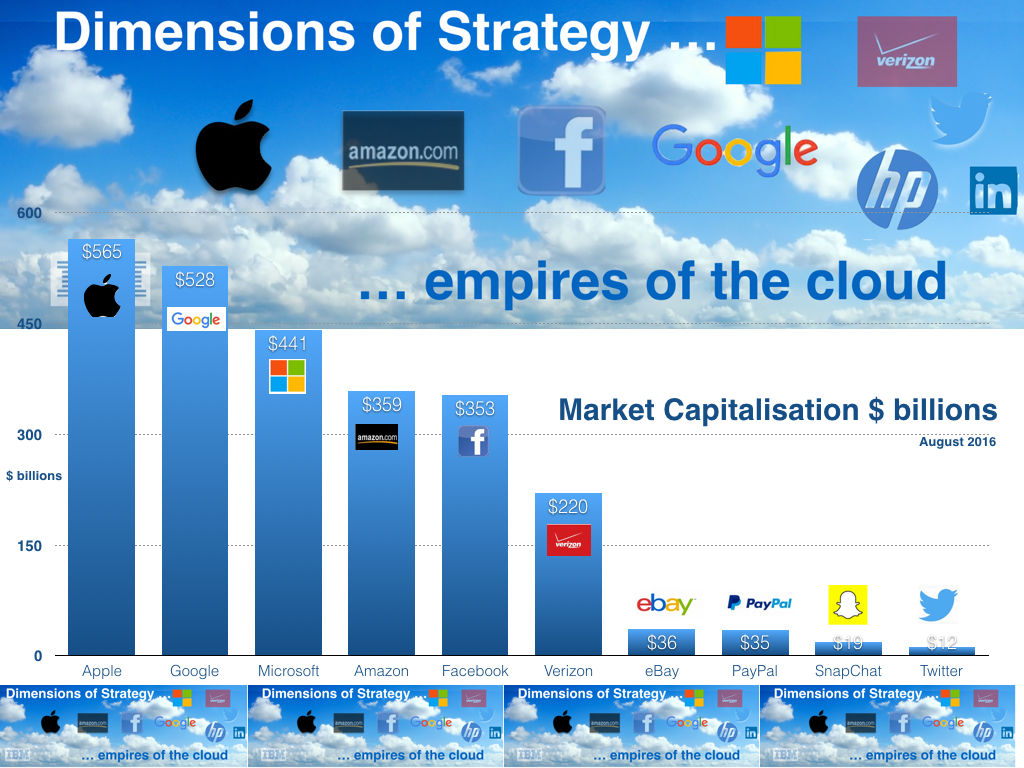

Digital Disruption and the Challenge to the Banking System … This week the Competition Market Authority [CMA] released the final report on the UK Banking System. Despite fears about digital disruption and the potential “uberization” of the bank network, change is slow to take effect. The report concludes the smaller, newer, “challenger” banks find it difficult to grow. Older, larger, legacy banks do not have to compete “hard enough” for customers’ business. Switching, the process by which customers change bank accounts from one bank to another is still extremely low. Switching accounts for between 3% and 4% of total current account business. The CMA would like to see the dominance of the Big Four, HSBC, Barclays, Lloyds and RBS diminished. In 2014 it is estimated the big four, plus Santander, have a combined UK current accounts market share of 85%. Add in TSB, Nationwide and the Co-operative Bank and the total increases to 97%. For the new challenger banks like OakNorth, Aldermore, Starling, Monzo and Atom the challenge is particularly difficult. Despite a strong Fintech mobile platform, Monzo, Starling, Atom and Tandem will struggle to recreate, in banking, the success of AirBnB and Uber in hotels and transportation. Scaleability is a difficult growth challenge when confronted with customer inertia. In banking, far more is at risk than calling a cab or booking a room. The commitment Life Time Value [LTV] has much more at stake as clients put their savings, houses and transactions on the line. Customer inertia, with a switching rate sub 4% will inhibit the growth of challengers whether digital or not. The marketing spend and capital requirements to achieve critical mass, are significant impediments to rapid growth. So what can the CMA achieve ...? The CMA would like to develop an “Open Banking” network. A world in which customers are able to move accounts more easily and more regularly. Price and performance comparisons should feature as part of the banks’ marketing profiles. APIs would be linked to all major banking systems. Clients would receive reliable, personalised, financial advice, precisely tailored to individual circumstances delivers securely and confidentially. Big data and predictive analytics would enable cash forecasting to warn of impending overspending. The standards set by the Empires of the Cloud, Google, Apple, Facebook and Amazon are becoming the norm for the banking network. “People who bought this also bought this, but you can’t afford it - so don’t look at that site again!” With Open Banking, apps could use transaction information to find the current account deals which suit best. Running a small business, apps could find the best options for business accounts and loans. Apps could even help avoid overdraft charges by moving cash into accounts when they dip into the red. Unfortunately the CMA fails to explain where the cash would come from. It’s all based on the wonderful world of fantasy banking. A world in which businesses and individuals never get into financial trouble. A world in which cash is always available at a tap of a button. Maybe soon, there will be an app for that. The “Money-App-tree” may be on the digital horizon but not just yet. More choice, more competition, greater market fragmentation, greater product innovation, disaggregation, right sizing the banks. It all sounds so easy. Monzo is about giving customers the data and insights into their spending and saving with warnings of overspend and shortage. But is that really a sufficient point of differentiation? Predictive capacity may be a wake up call for the legacy banks but not much more. Big progress is already being made by the big four and others in the world of relationship banking. Banks are adapting. Capital One Bank acquired UX design agency “Adaptive Path” and the App - Level Money to push ahead in the digital space. How the Big Banks will respond ... ? The legacy banks have size and experience on their side. They have big balance sheets and big networks plus experience with the regulators, retaining the confidence of investors and clients. They have established relationships, data history, data availability, a spread of products, services, risk management analysis and the scale of operations to sustain large market shares. They do have legacy software systems and architecture which are demanding huge investment to make the move to digital and mobile. They are responding by developing startup or VC programmes with FIntech companies, partnering or acquiring Fintechs or developing resource in house. Santander’s Innovation, Barclays Pingit App and Accelerator schemes, Lloyds Digital Champions, Citibank’s Digital Mobile Challenge and Digital Acceleration teams are witness to the response to the challenge. Fintechs will struggle to gain critical mass. The legacy banks will react by collaborating, competing or acquiring either totally or by partial investment. Doing nothing is not an option. Empires of the Cloud … The Empires of the Cloud, Google, Apple, Facebook and Amazon are defining the standards for digital UX user experience and UJ user journey. Millennium clients are expecting the same standards of service and response from banking platforms as they are from Amazon and others. Payment offers easy pickings as a challenge to the banking network. It is the most vulnerable to digital disruption. 2015 was the year of successful IPOs from PayPal, Square and WorldPay. The success of Paypal and Transferwise have determined the standards for ease and speed of money transfers both nationally and internationally. New players like Transferwise may grab the headlines but Western Union will remain the dominant player in the international payment market. Visa and MasterCard remain strong players in the transaction market. “Contactless” is a great step forward in the digital age. Google, Apple, Facebook and Amazon all have payment options with “Wallet” (differential card payment options) as an enhancement. Facebook paid $19 billion for WhatsApp as an addition to the social media network. The pattern of payment via messaging options have been set by WeChat in China. Payment and messages are able to use the same platform among Facebook’s 1.7 billion users worldwide. Empires of the Cloud will be the main threat to the banking system rather than the newer, smaller Fintechs. Apple, Google, Facebook, Amazon have the relationships and the platforms to disrupt the conventional banking network. Once the banks are obliged to access with APIs then the disruption is eased significantly. Will we see the Bank of GAFA in the years ahead? An interesting thought when one considers the combined capitalisation of the Empires of the Cloud is $2.5 trillion dollars. RBS, Barclays and Lloyds, each would represent a modest premium to a WhatsApp deal based on current valuations. Imagine if the Empires strike back, what would the CMA make of that! Happy (Digital) Strategies, John

1 Comment

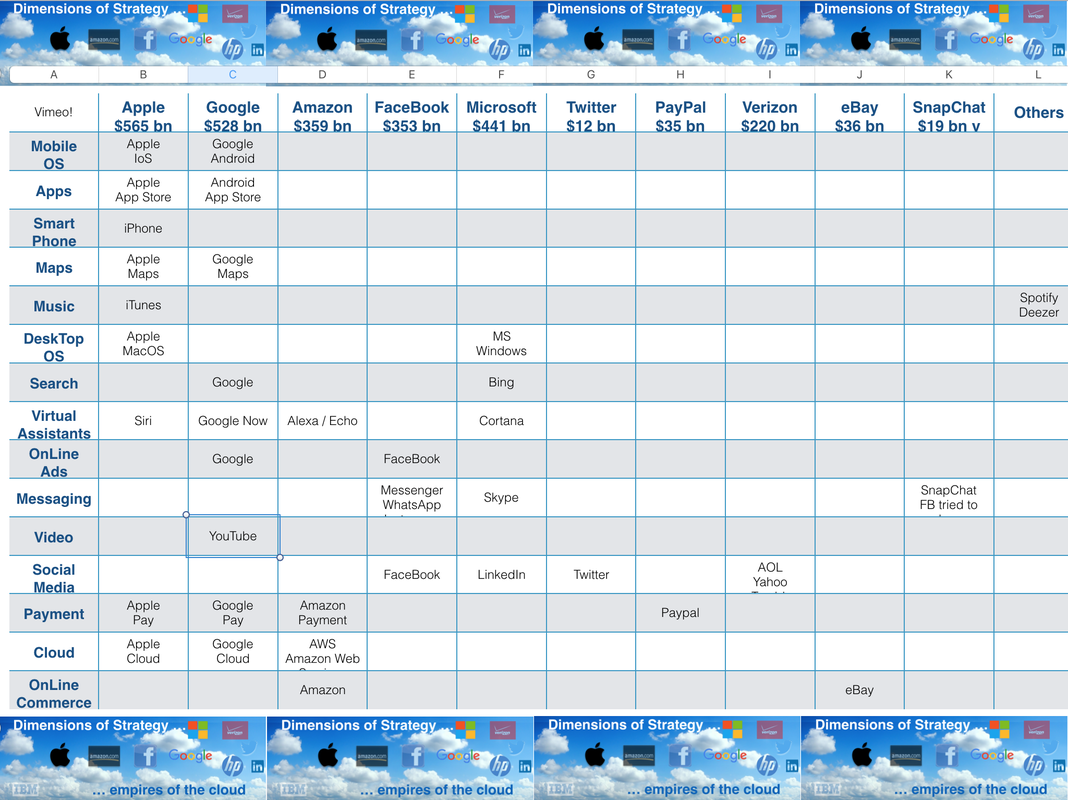

Empires of the Cloud ... Empires of the Cloud are dominating internet activity. Software as a Service is yielding to Business as a Platform. We hear much about Uber and Airbnb as the great disruptors. Uber is the largest taxi firm in the world, yet has no vehicles, Airbnb is the largest “room rental" business in the world but owns no hotels. In reality, Uber and Airbnb are minor niche players in the great game. Five key “Empires of the Cloud” are emerging. Apple, Google, Microsoft and Facebook are joined by Verizon, making a late run. Together our top five “Empires of the Cloud”, have a combined market value of $2.5 trillion dollars. The battlegrounds have formed on which the empires will joust. The quest for dominance is relevant and real. Google dominates search, Facebook and Google dominate on line advertising. Amazon dominates online commerce. Apple and Google dominate mobile software and apps marketing. Personal Assistants rival amongst the big four. Apple’s Siri, Google’s Now, Microsoft’s Cortana and Amazon’s Alexa-Echo, each seek to have the last word. In Social media, Facebook is the dominate player with 1.7 billion monthly users. It is a huge player, intent on maintaining dominance. The acquisitions of Instagram and WhatsApp, the latter for $16 billion, are evidence of Facebook’s commitment to the cause. Attempts to acquire Snapchat for $3 billion have failed to date. The launch of Instagram “Stories” is clearly targeted at the reluctant seller. Facebook hosts “Messenger”, alongside Instagram and WhatsApp to provide a comprehensive social media offer. Verizon acquires Yahoo … Verizon’s acquisition of Yahoo brings Yahoo and Tumblr into the Verizon stable to sit along side AOL. Yahoo’s 700 million MAUs are a big addition to the empire. Microsoft’s acquisition of LinkedIn for $16 billion brings over 300 million MAUs into the Microsoft camp. In payment, Apple Pay, Google Pay and Amazon Pay have strong payment platforms to support the high level of platform transactions. PayPal is the major independent with a strong history with eBay. PayPal and eBay are currently valued at $35 billion. Twitter and Snapchat with market caps of under $20 billion sit as acquisition fodder before the Empires of the Cloud. New Empires of the Cloud are governed by the old rules of competitive strategy. The race to critical mass is important for market dominance. For new business platforms, development is a function of runway and burn rate. Serial losses may be sustained in start up phase, as long as the model fundamentals are correct. Cost of Acquisition cannot exceed Life Time Values. Transactions with revenues below cost, may be OK as a short term loss leader for certain items but not in the overall product mix. Walmart’s acquisition of Jet is an interesting case in point. According to the Wall Street Journal, transactions sustained at a loss were a significant part of the Jet retail model. In October last year, Jet had a monthly burn rate of $40 million, including a $25 million advertising budget. With $63 million of cash left at the end of October, the company avoided a cash crunch when it raised $350 million in November. It is suggested Walmart is paying $3 billion for an unproven retail model to boost online performance and create a rival platform to Amazon. Good luck with that! Empires expand, laterally, horizontally and vertically. Empires will seek to expand where the perceived value is greatest. Sometimes, this will involve co-opetition, working with the enemy. Take note, Alibaba (not Baidu) owns search on Alibaba. Facebook (not Google) owns search on Facebook. Apple, dependent on Google for Maps for the iPhone decided to drop Google. The decision to develop an Apple “Map App” in house was strategically important, albeit badly executed at the out set. Yahoo made a great strategic mistake in surrendering search to Google as we explain in The Yahoo Case Study. Facebook and WhatsApp… The Facebook acquisition of WhatsApp for £19 billion was as much a defensive acquisition as it was a strategic play. WhatsApp has more than 400m users around the world heading for one billion within the next three years, or so it is hoped. Facebook’s successful close in 2014 followed a Google offer of $1 billion for the company in the previous year. Facebook was prepared to overpay to avoid a rival empire seizing control. In China, the empires are well established with Alibaba in commerce, Baidu in search, WeChat in messaging and Xiaomi in mobile. For the firms of the West China is a difficult market. Last month Uber made a strategic withdrawal, swapping China operations for a stake in homegrown rival, Didi Chuxing partially owned by Baidu. Empires of the Cloud operate within the old rules of the game. We define the battlegrounds amongst search, advertising, payment and many more. Empires monitor the battleground using our formula of CBS News. Competitors, Buyers, Suppliers, New Products, New Players, New Platforms and New technologies. Product life Cycles are significant as always in monitoring corporate performance. Snapchat will face a greater challenge from Google’s Instagram. Etsy will face the challenge of Amazon Homemade. The development of cloud has seen the emergence of Apple, Google and Microsoft Cloud Products. Nothing compares to the dominance of Amazon Web Services in the provision of cloud storage for many online platforms. AWS provides a great ability, along with Amazon Platform, to monitor performance of the new arrivals, ready to move when the time is right! New entrants will come and go but the Empires of the Cloud will be watching every move … Happy (Digital) Strategies, |

John Ashcroft

Masters of Strategy on Digital Disruption from the Dimensions of Strategy Team ... experience worth sharing ... Archives

May 2023

Categories

|

- Home

- Artificial Intelligence

- Digital Disruption

- Digital Accommodation

- The Master Class

- The Case Studies

- Empires of the Cloud

- Letters to a Friend on Social Media ...

- The Tool Box

- Five Dimensions

- CRIMSON Clouds

- Market Mapping

- CBS News

- PESTEL framework

- Kaizen and KSFs

- Business Modelling

- 7 Ss Framework

- Crisis Management

- Secrets of a great presentation

- Business Planning

- Fishing in a Pond?

- About

- The Apple Case Study

- The Lego Case Study

- The Yahoo Case Study

- The Twitter Case Study

RSS Feed

RSS Feed